Litecoin Price Prediction 2025: Technical Setup Suggests Accumulation Opportunity

#LTC

- LTC trading at significant discount to 20-day moving average suggests technical bounce potential

- MACD momentum indicator remains positive despite recent price weakness

- Bollinger Band positioning indicates oversold conditions that typically precede rebounds

LTC Price Prediction

LTC Technical Analysis: Oversold Conditions Suggest Potential Rebound

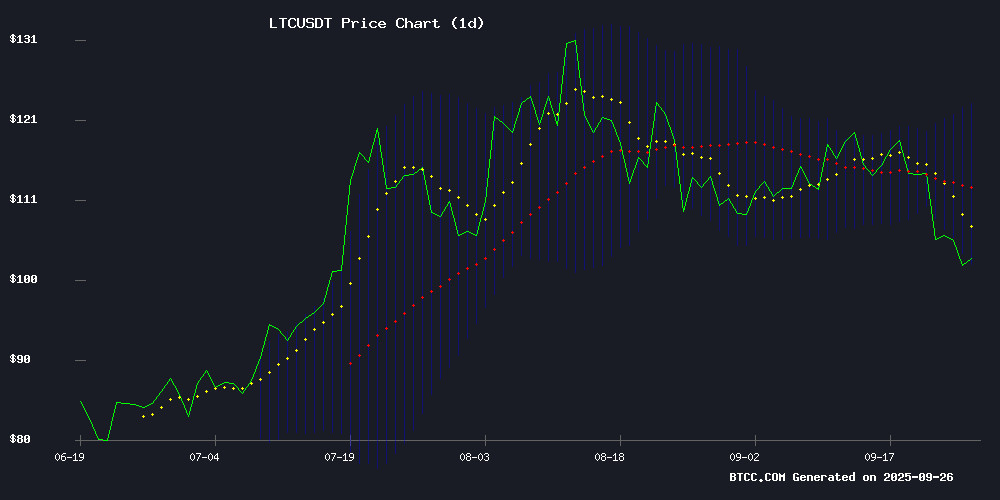

Litecoin is currently trading at $102.53, significantly below its 20-day moving average of $112.67, indicating potential oversold conditions. According to BTCC financial analyst Mia, the MACD reading of 2.98 shows bullish momentum despite recent price weakness. 'The fact that LTC is trading NEAR the lower Bollinger Band at $102.34 suggests we might see a technical bounce,' Mia notes. 'The $102-103 level appears to be forming a support zone that could trigger buying interest from technical traders.'

Market Sentiment: Litecoin Shows Resilience Amid Broader Crypto Dip

Recent news highlights Litecoin's relative strength during market turbulence. BTCC financial analyst Mia observes that 'while the broader crypto market faces pressure, LTC is demonstrating notable resilience alongside XRP and Cardano. The cloud mining developments for 2025 could provide additional utility demand for Litecoin.' Mia cautions that 'despite healthy US economic data, crypto markets aren't rallying, suggesting sector-specific factors are at play. Litecoin's established network effects continue to support its medium-term outlook.'

Factors Influencing LTC's Price

Top Cloud Mining Platforms for Passive Crypto Income in 2025

Cloud mining continues to disrupt traditional cryptocurrency acquisition methods, offering investors a hardware-free path to Bitcoin, Litecoin, and Dogecoin rewards. DNSBTC emerges as the market leader in 2025, leveraging U.S.-based operations and renewable energy infrastructure to deliver daily payouts with contract returns reaching 9.5%.

The platform's tiered investment structure accommodates both retail and institutional participants, featuring $60 starter contracts and $10,000 high-yield options. Its affiliate program compounds profitability with 4% referral commissions, while geo-distributed data centers in Canada and Iceland mitigate operational risks.

Crypto Price Prediction Today: XRP, Cardano, Litecoin Show Resilience Amid Market Dip

The cryptocurrency market's selloff has extended into another day, but the downturn is improving medium-term outlooks for XRP, Cardano, and Litecoin. While these assets have suffered significant losses, oversold conditions suggest potential for robust recoveries.

XRP's 9.5% weekly decline to $2.82 masks its impressive 380% annual gain. The altcoin's fundamentals remain strong, with expectations building for imminent ETF approvals that could drive institutional demand. Technical indicators confirm its oversold position, setting the stage for a rebound.

Cardano and Litecoin mirror this pattern of temporary weakness amid long-term strength. The broader altcoin market shows varied performance, with Solana, Dogecoin, and Avalanche experiencing steeper 24-hour losses exceeding 4%.

US Economic Data Shows Healthy Q2 Growth, So Why Aren’t Markets Rallying?

Despite bullish US economic reports showing a 3.8% GDP growth in Q2 2025 and declining jobless claims, markets remain skeptical. The Nasdaq and S&P 500 posted minor downturns, while the crypto market saw broad declines across leading tokens.

Analysts from Harvard and Bloomberg have raised concerns about the authenticity of the data, with many investors dismissing the reports as fabricated. This growing distrust is injecting volatility into already unpredictable markets.

The disconnect between positive economic indicators and market performance suggests deeper structural issues. Cryptocurrencies, often seen as a barometer for risk appetite, appear particularly sensitive to these credibility concerns.

Is LTC a good investment?

Based on current technical and fundamental analysis, LTC presents a compelling risk-reward profile for medium-term investors. The cryptocurrency is trading 9% below its 20-day moving average, which historically has provided attractive entry points. BTCC financial analyst Mia suggests that 'current levels offer accumulation opportunities for patient investors, though position sizing should reflect the inherent volatility of digital assets.'

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | -9% discount | Bullish |

| Bollinger Band Position | Lower band | Oversold |

| MACD | 2.98 positive | Momentum building |